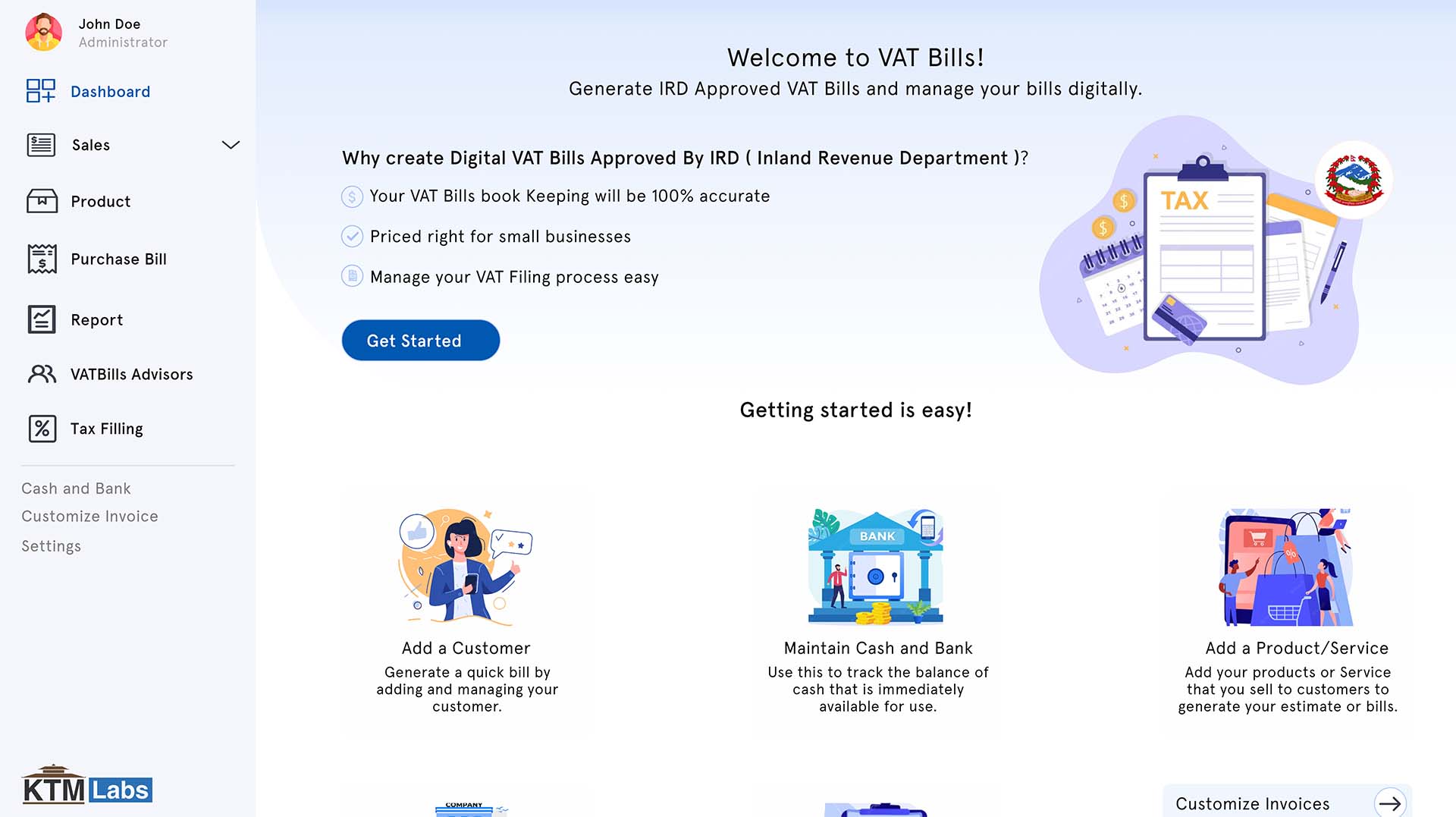

Welcome to VAT Bills e-billing System

Generate IRD Approved VAT Bills and manage your bills digitally.

Why to Use VAT Bills e-billing?

Approved by Inland Revenue Department

Keeping things 100% accurate, efficient, time saving and error free.

Pricing right for all businesses

Easy VAT and reporting

Trusted By

200+

Clients

Features

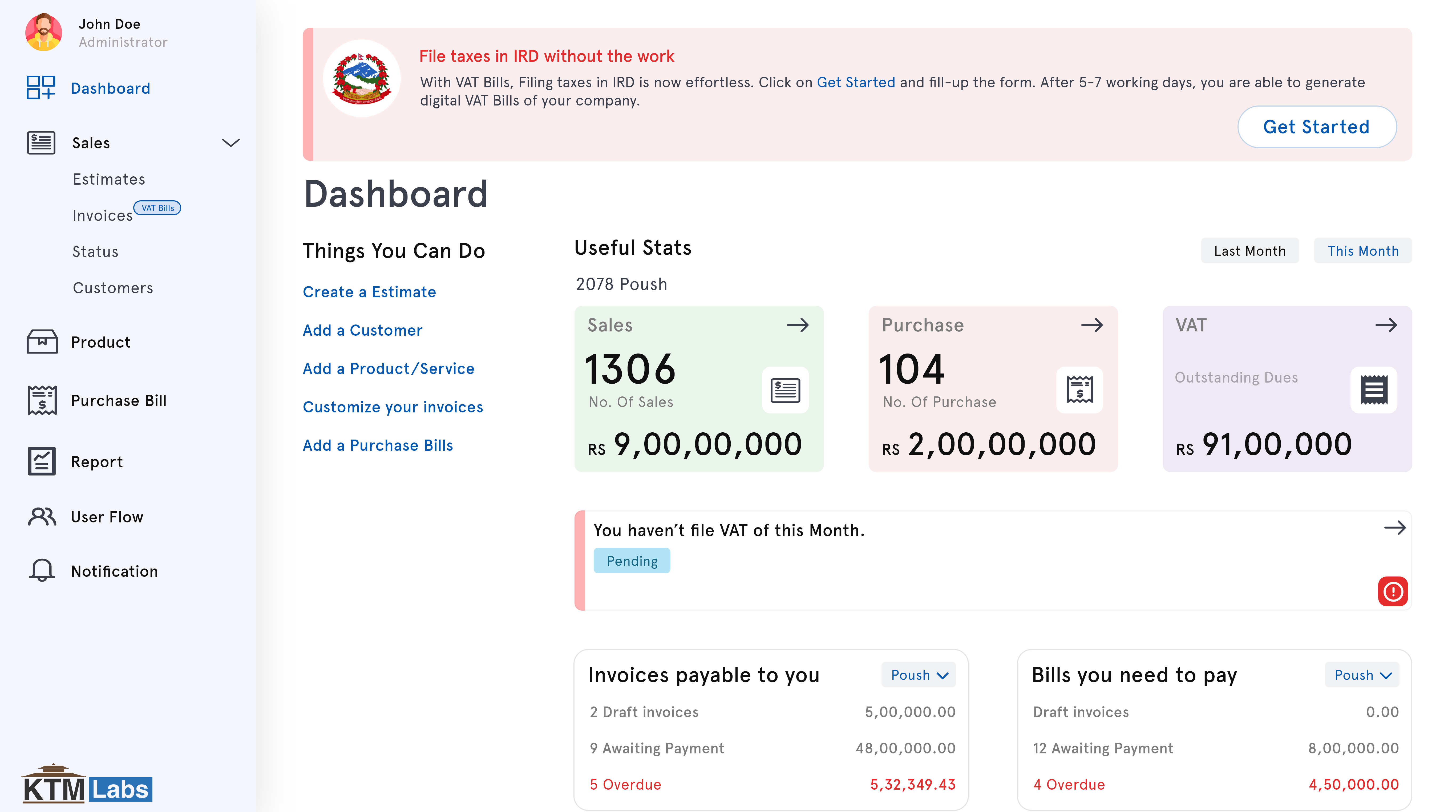

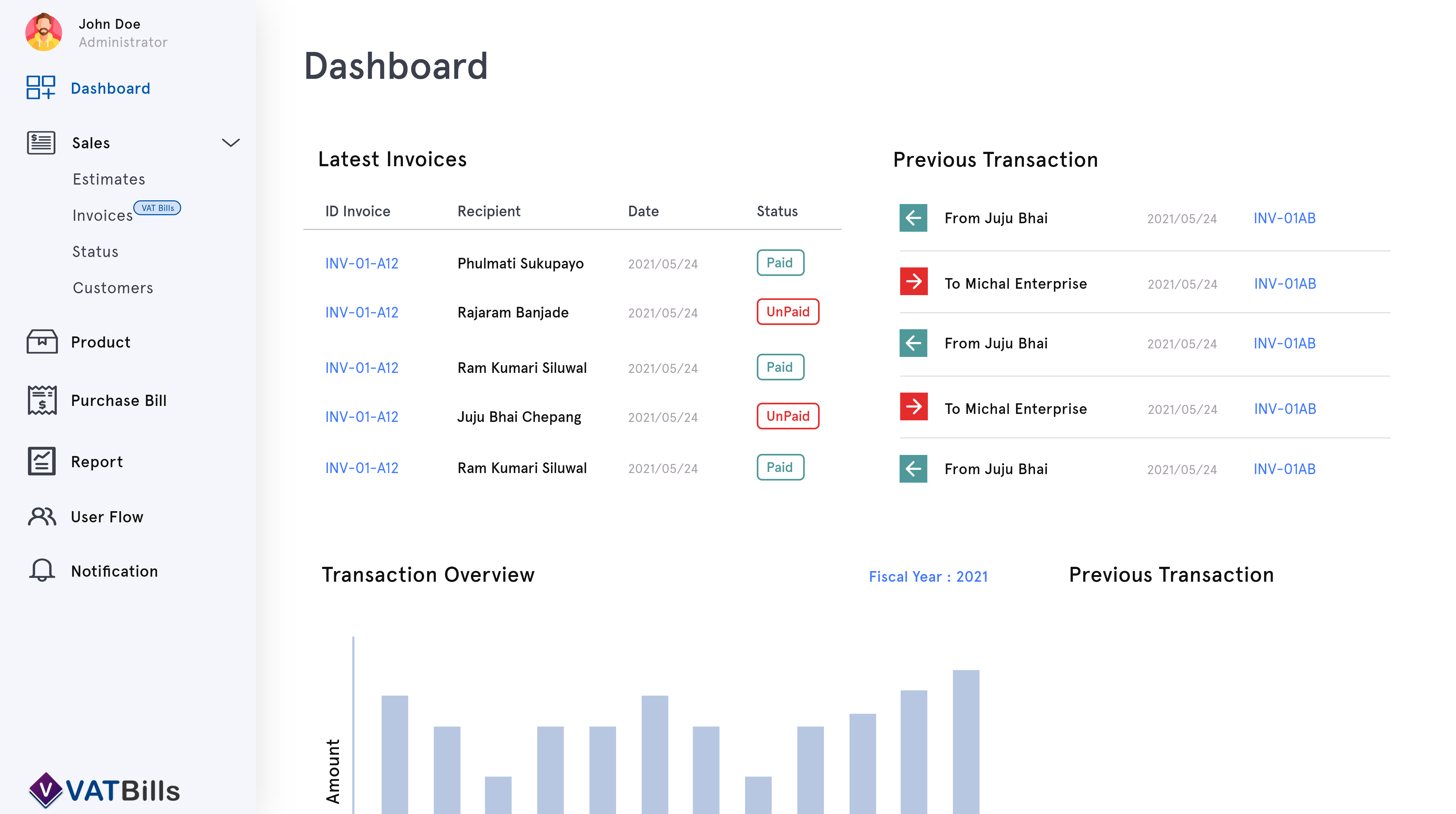

Getting started is easy!

For Teams

Generate your own business by

adding and managing your customers and products/services.

Maintain Cash and Bank

Use this to track the balance of cash that is immediately available for use and generate an overview of transaction reports.

Add a Product/Service

Add your products or Service that you sell to customers to generate your estimate or bills.

Add a Vendor

Add a Vendor or Supplier from which you have taken services or products and view the transactions summary with them.

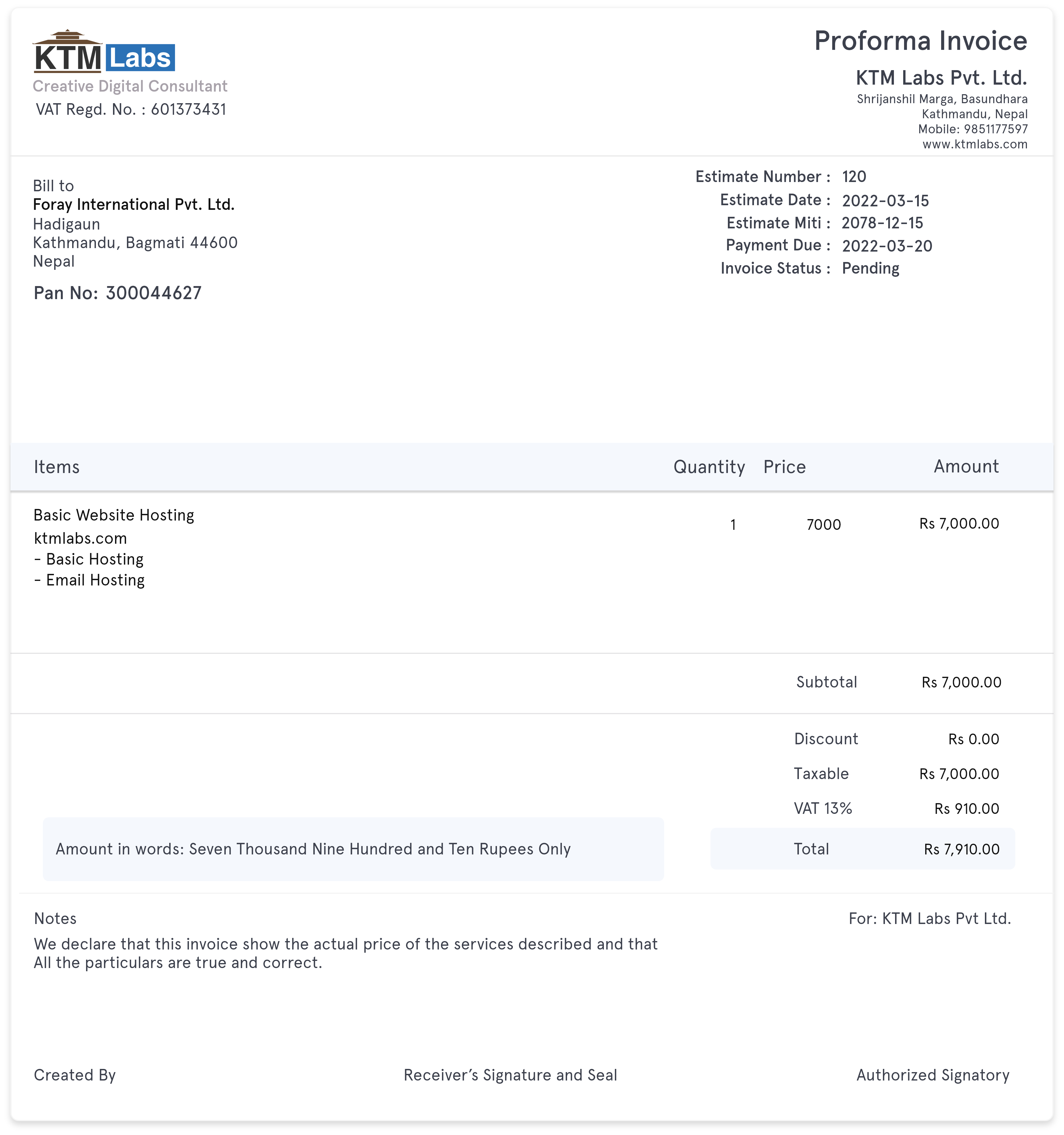

Create Estimate

Create a Estimate for Clients or Performa Invoice before generating a VAT Bills.

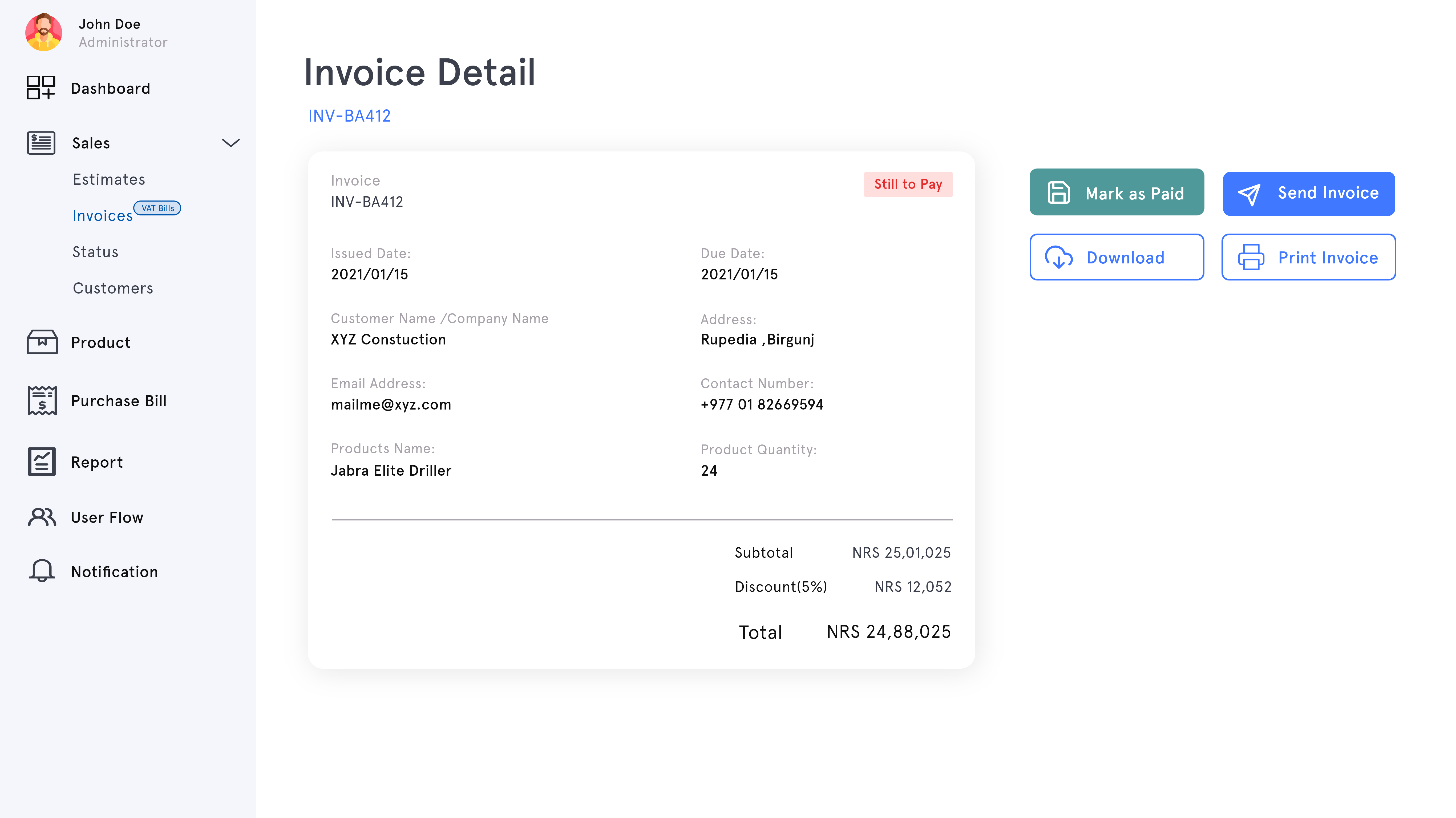

Generate VAT Bills

Generate quick VAT Bills/Tax Invoices by choosing your customer and products/services.

Approved by Revenue Department

VAT Bills have been tested and approved by Inland Revenue Department

100% Accurate and Efficient

Keeping things 100% accurate, efficient, time saving and error free.

Pricing right for all businesses

Pricing right for all businesses

Easy VAT and reporting

Keeping things 100% accurate and Easy VAT and reporting

Pricing

A Plan For Every Team Size

From Small to big Enterprises. VAT Bills is for all business sizes. We help in generating digital IRD-approved VAT Bills. Each Bill is backup and synced in real time.

Basic Package

NPR 24,999/year

Best Value for customers whose total number of transaction is less than 499.

Create Quotation or Estimate

Convert Quotes/Estimate into Tax Invoice

Each Bill is sycned and Backup

Create Credit Note and Debit Note

Generate Customer Statement

Generate Monthly Filing Report for IRD

Calculate Total Balance

Generate Annex-13 report

Data Security

Essential Package

NPR 34,999/year

With Notification feature, you won’t miss VAT Filing Date.